Consequently, the standing deposit facility (SDF) fee stays at 5.25% whereas the marginal standing facility (MSF) fee and the Bank Rate stay at 5.75%.

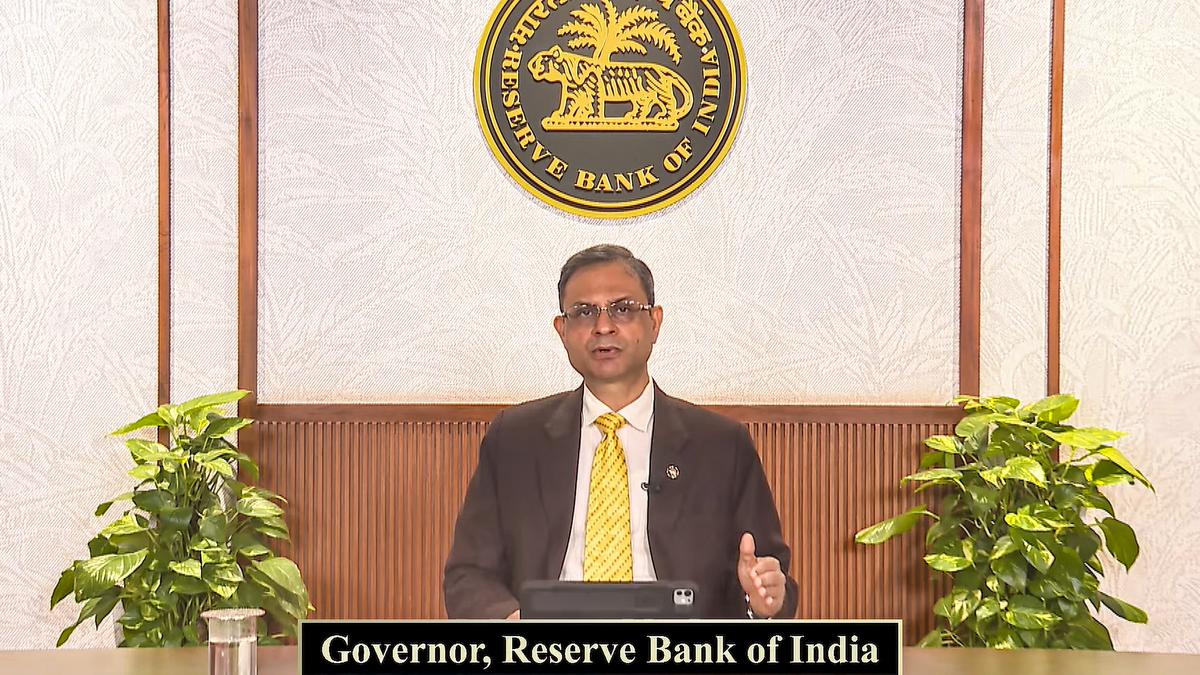

RBI MPC assembly updates on October 1, 2025

The MPC additionally determined to proceed with the impartial stance.

”The MPC noticed that the general inflation outlook has turned much more benign in the previous few months, because of a pointy decline in meals costs and the rationalisation of GST charges. The common headline inflation for 2025-26 has been revised decrease from 3.7% projected in June and three.1% in August, to 2.6%,” Reserve Bank of India (RBI) governor Sanjay Malhotra mentioned within the Governor’s assertion.

”Headline inflation for This fall:2025-26 and Q1:2026-27 too have been revised downwards and are broadly aligned with the goal, regardless of unfavourable base results. Core inflation for this 12 months and Q1:2026-27 can also be anticipated to stay contained,” he mentioned.

”The MPC additionally famous that the expansion outlook stays resilient, supported by home drivers, regardless of weak exterior demand. It is prone to get additional help from a beneficial monsoon, decrease inflation, financial easing and the salubrious influence of latest GST reforms. However, progress continues to be under our aspirations,” he mentioned.

“Even although the expansion projection for the present monetary 12 months is being revised upwards, the forward-looking projections for Q3 and past are anticipated to be barely decrease than projected earlier, primarily because of trade-related headwinds, regardless of being partially offset by the impetus supplied by the rationalisation of GST charges,” he added.

The Governor mentioned that the MPC concluded that there was a big moderation in inflation. Moreover, the prevailing international uncertainties and tariff associated developments are prone to decelerate progress in H2:2025-26 and past.”

“The present macroeconomic situations and the outlook has opened up coverage house for additional supporting progress. However, the MPC famous that the influence of the front-loaded financial coverage actions and the latest fiscal measures remains to be taking part in out,” he mentioned.

”The trade-related uncertainties are additionally unfolding. The MPC, subsequently, thought of it prudent to attend for the influence of coverage actions to play out and higher readability to emerge earlier than charting the following plan of action,” he mentioned.

Accordingly, the MPC unanimously voted to maintain the coverage repo fee unchanged at 5.5% and determined to retain the stance at impartial, he added.

Taking numerous elements into consideration, actual GDP progress for 2025-26 is now projected at 6.8%, with Q2 at 7.0%, Q3 at 6.4%, and This fall at 6.2%.

Real GDP progress for Q1:2026-27 is projected at 6.4%. The dangers are evenly balanced. Also contemplating numerous elements, together with the impact of the GST lower, CPI inflation for 2025-26 is now projected at 2.6% with Q2 at 1.8%; Q3 at 1.8%; and This fall at 4.0%. CPI inflation for Q1:2026-27 is projected at 4.5percentt. The dangers are evenly balanced.

In his opening remarks, Mr. Malhotra said that because the August coverage assembly, there had been vital developments on the home entrance amidst a fast-changing international financial panorama, which have altered the narrative on growth-inflation dynamics in India.

“Buoyed by a very good monsoon, the Indian financial system continues to exhibit power by registering a better progress in Q1:2025-26. At the identical time, there was a substantial moderation in headline inflation. The rationalisation of the products and companies tax (GST) charges is prone to have a sobering influence on inflation whereas stimulating consumption and progress. Tariffs, alternatively, will reasonable exports,” he noticed.

“As for the worldwide financial system, it has been extra resilient than anticipated, with sturdy progress within the U.S. and China. The outlook, nonetheless, stays clouded amidst elevated coverage uncertainty. Inflation has remained above respective targets in some superior economies, posing recent challenges for central banks as they navigate the shifting progress–inflation dynamics,” he said.

“Financial markets have been unstable. The US greenback strengthened after the upward revision of U.S. progress numbers for the second quarter, and treasury yields hardened not too long ago as expectations of fee cuts by the Federal Reserve ebbed. Equities have remained buoyant throughout a number of superior and rising economies,” he identified.

Leave a Comment