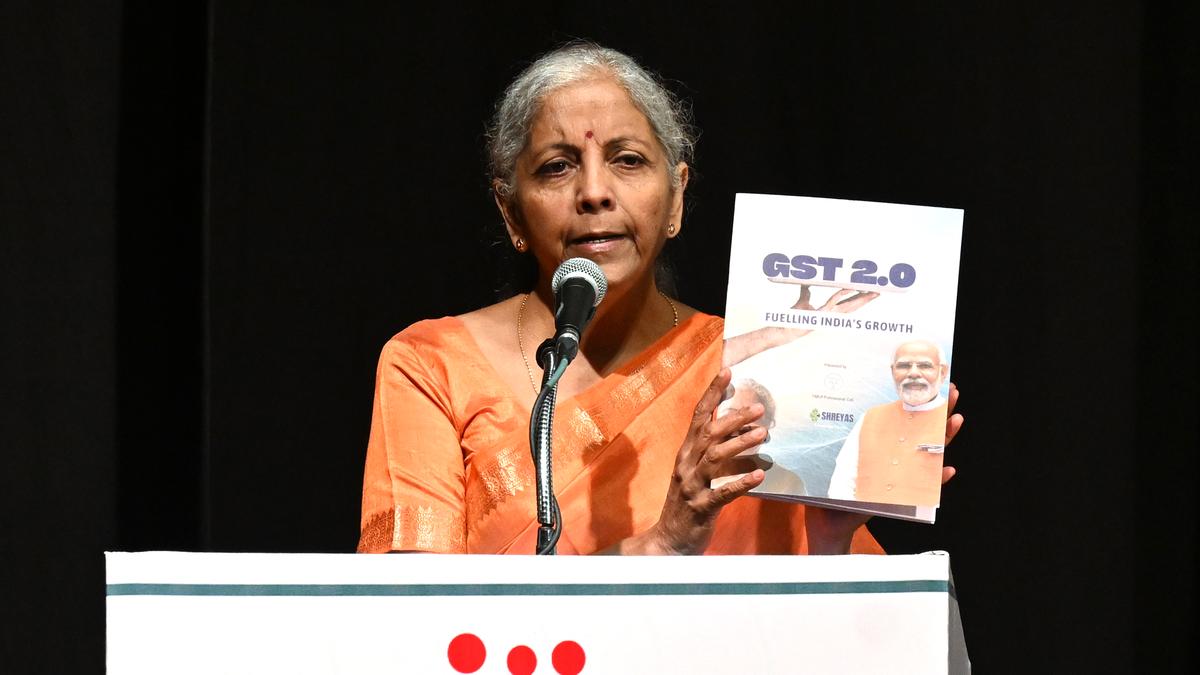

Union Finance Minister Nirmala Sitharaman addressing the joint conclave of Trade and Industries Association on the subject ‘Tax Reforms for Rising Bharat’ at Music Academy in Chennai on September 14, 2025 | Photo Credit: B. Jothi Ramalingam

Addressing the joint conclave of Trade and Industries Association in Chennai on the subject ‘Tax Reforms for Rising Bharat’, she stated within the newest GST reforms, 99% of all the products which had been within the 12% GST bracket have now come underneath the 5% GST bracket.

“This is a reform which touches the lives of all 140 crore folks. The GST price cuts within the vary of 10-13% will cut back the bills for folks and so they can use that further financial savings elsewhere,” Ms. Sitharaman stated.

She additionally expressed confidence that the businesses would go on the advantages of price cuts to the customers. “When the GST was launched in 2017, there have been 65 lakh taxpayers. Today there are 1.51 crore taxpayers,” she added.

“The gross GST receipts which had been ₹7.19 lakh crore in 2017 has now touched ₹22 lakh crore. On common, monthly GST assortment is ₹1.9 lakh crore or ₹2 lakh crore for Central and State governments which is split within the ratio of fifty:50,” Ms. Sitharaman stated.

“If the month-to-month GST assortment is ₹1.8 lakh crore, ₹90,000 crore goes to the States and ₹90,000 crore involves the Centre. Out of the Centre’s ₹90,000 crore, 41% goes to the States,” she added.

Ms. Sitharaman famous that just about eight months of labor went into GST 2.0 reforms and the speed rationalisation was effected with cooperation from Finance Ministers of all States within the GST Council. “GST charges for over 350 gadgets have been lowered,” she famous.

“Systems have been simplified in order that GST registration might be completed in three days,” Ms. Sitharaman stated. “Another main step is addressing the product classification issues in GST 2.0,” she stated.

“There had been totally different Court rulings on GST charges from totally different States,” she talked about.

“Now we’ve introduced all meals gadgets at 5% or 0%. So there is no such thing as a classification downside. We have introduced related classification for one sort of products. We labored on it for eight months wanting into every merchandise and what class it ought to be categorized,” Ms. Sitharaman stated.

She additionally identified that the reduce in private earnings tax charges, the brand new Income Tax Act and the GST reforms have all been completed in a span of eight months. The GST refunds have additionally been simplified, Ms. Sitharaman stated.

“The GST reforms was a coverage pushed train. We did it retaining in thoughts 5 main factors — whether or not there might be modifications in every day use gadgets, whether or not we’re bringing modifications within the every day use gadgets utilized by poor and center class, whether or not it might be useful for the farmers, whether or not the uncooked materials price for MSMEs would come down and at last whether or not it should profit the sectors which is able to increase the financial system,” she stated.

Speaking on the occasion, A.R. Unnikrishnan, Chairman of CII Tamil Nadu State Council and G.S.Okay. Velu, Chairman, Federation Of Indian Chambers Of Commerce and Industry (FICCI) and Tamil Nadu State Council amongst different industrialists welcomed the GST reforms.

Linesh Sanatkumar, President, Hindustan Chamber of Commerce stated the rise in GST price of paper and paperboard to 18% from 12% has come as a significant shock to the complete fraternity.

He additionally hunted for rationalisation of GST on coastal delivery and inland water transport (IWT) that are acknowledged as the important thing driver for lowering logistics price in India and different measures.

Tamil Nadu Traders Association President A.M. Vikramaraja flagged the difficulty of harassment of merchants by some GST officers and sought formation of a committee to handle the difficulty. He additionally sought a scheme to allow merchants to settle previous GST dues.

Published – September 14, 2025 05:21 pm IST

Leave a Comment