She added that the choices would come into impact from September 22 for many gadgets. Only tobacco and tobacco-related merchandise will transfer to the brand new construction at a date to be specified by the Finance Minister.

Also learn: GST Council assembly LIVE Updates

Apart from the 2 charges of 5% and 18%, the brand new GST system would additionally embody a 40% “particular charge” on sin items akin to tobacco and luxurious gadgets akin to giant vehicles, yachts, and helicopters.

The authorities additionally calculated that the web fiscal implication of the speed cuts, based mostly on consumption patterns in 2023-24, could be ₹48,000 crore. However, the officers clarified that the actual implication could be recognized on the premise of present consumption, and that the speed rationalisation was anticipated to end in a buoyancy impact, and improved compliance.

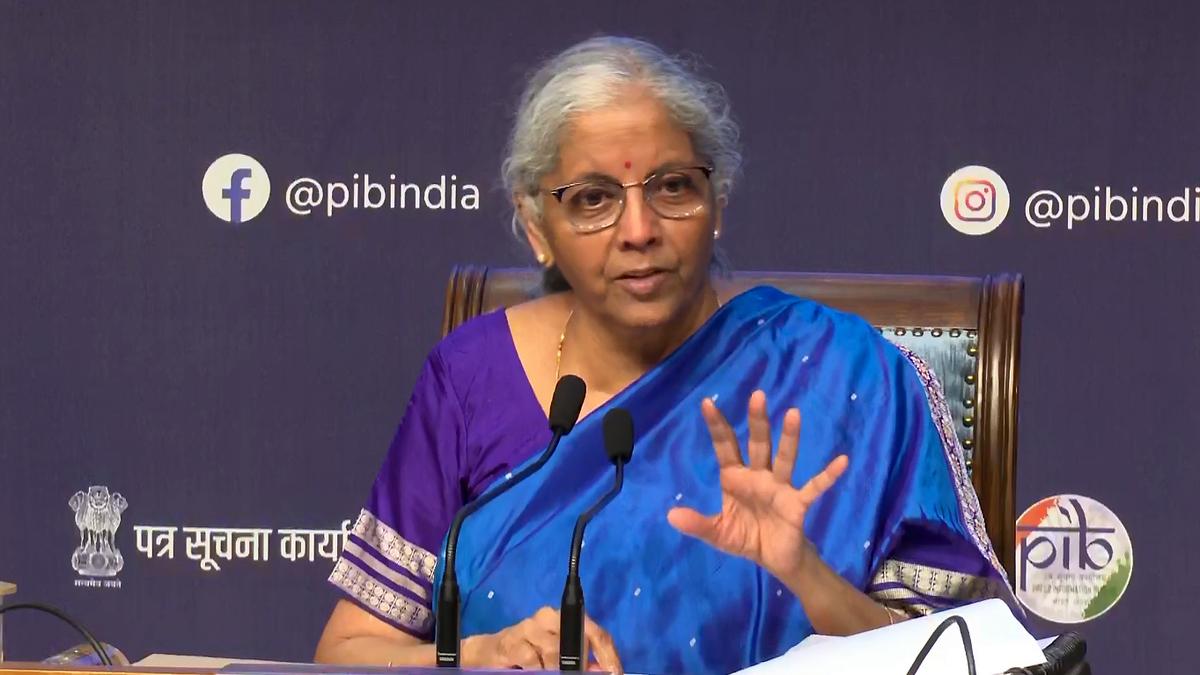

“These reforms have been carried out with a deal with the widespread man,” Ms. Sitharaman stated. “Every tax levied on the widespread man has gone via a rigorous trying into, and usually, the charges have come down. Labour-intensive industries have been given good help. Farmers and agriculture will profit from the choices. Health-related sectors can even profit.”

Rate cuts for widespread man

She additional stated that common-use and middle-class gadgets will see a discount, with merchandise akin to hair oil, cleaning soap, shampoo, toothbrush, toothpaste, bicycle, desk and kitchen ware, and different family articles being moved to five% from both 18% or 12%.

The different gadgets shifting right down to the 5% charge embody namkeens, sauces, pasta, instantaneous noodles, goodies, espresso, and butter. Twelve specified bio-pesticides, bio-menthol, and labour-intensive gadgets akin to handicrafts, marble, travertine blocks, granite blocks, and intermediate leather-based items would transfer from 12% to five%.

Notably, cement will transfer from 28% to 18%.

The Finance Minister additional defined that gadgets akin to ultra-high temperature milk, paneer, and all Indian bread, together with rotis, chapatis, and parathas would see their tax charge fall to 0% from the sooner 5%.

Products akin to air-conditioners, all TVs, dishwashers, small vehicles, and bikes of engine capability lower than or equal to 350cc would see their tax cut back from 28% to 18%. Buses, vehicles and ambulances, in addition to all auto elements, would additionally appeal to a GST charge of 18%.

The Finance Minister additional stated that 33 lifesaving medication and medicines will transfer from 12% to 0%, whereas spectacles to appropriate imaginative and prescient would transfer from 28% to five%.

Also learn | Who are the members of the GST Council and what’s their voting energy?

Inversion rectified

“The long-pending inverted responsibility construction is being rectified for the artifical textile sector by lowering the GST charge on artifical fibre from 18% to five% and artifical yarn from 12% to five%,” Ms. Sitharaman stated. “That will deal with each anomaly on account of responsibility inversion on this sector.”

The inverted responsibility construction concerning fertilizers can even be rectified, with the responsibility on sulphuric acid, nitric acid and ammonia being lowered from 18% to five%.

The particular charge of 40% will apply solely on specific sin and super-luxury items akin to pan masala, cigarettes, gutka, chewable tobacco, zarda, unmanufactured tobacco and bidi, in addition to items together with aerated water, caffeinated drinks, mid-size or giant vehicles, bikes of engines exceeding 350cc, helicopters and airplanes for private use, and yachts or different vessels for personal use.

On insurance coverage companies, particular person life insurance coverage insurance policies and particular person well being insurance policies will transfer to 0% from 18%.

Ms. Sitharaman additional defined that the GST charge on pan masala, gutka, cigarettes, chewable and unmanufactured tobacco, and bidi would stay at 28%, along with a compensation cess, as at present in place.

Once the Centre discharges the loans it had borrowed to compensate States, these tobacco and tobacco-related gadgets will transfer to the 40% slab. Ms. Sitharaman stated the mortgage would doubtless be repaid inside this calendar yr.

Leave a Comment