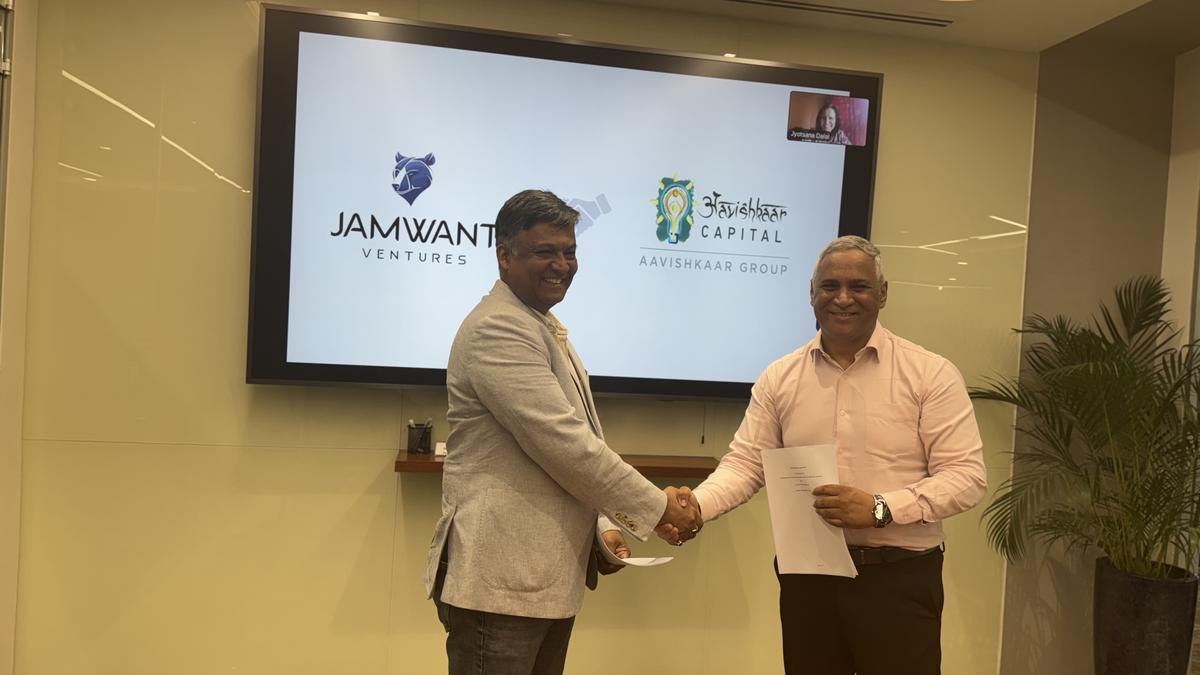

Aavishkaar Group and Jamwant Ventures have launched a ₹500-crore fund for defence and deep tech startups | Photo Credit: Special Arrangement

Navneet Kaushik, founding father of Jamwant Ventures, instructed The Hindu that the thought is to put money into 20-25 firms. “I’m firms that are barely mature, however sure, we are going to do seed as nicely,” he mentioned. Mr. Kaushik indicated the groups have began evaluating just a few startups on this house. They are within the means of launching the fund and anticipate to file with SEBI by the top of this month. Once the mandatory approvals are in place and the fund is launched, deployments are anticipated to start early subsequent 12 months.

Tarun Mehta, companion, Funds & Strategy, Aavishkaar Capital, mentioned: “We can have a illustration of Aavishkaar on the funding committee of the brand new fund. We will help Jamwant in terms of diligence or exit planning, and many others. Navneet and his workforce are very prolific find the deal and executing it.”

Jamwant Ventures is a sector-specialist funding agency centered on defence and deep tech innovation in India.

Their first fund, ‘Jamwant Ventures Fund 1’, has efficiently deployed capital throughout high-potential startups aligned with nationwide safety and indigenisation targets.

According to each corporations, ‘Jamwant Ventures Fund 2’ will probably be a gamechanger for defence and deep tech startups. This will supply startups early capital backing with strong ecosystem of companions, pilots, and coverage linkages. Startups can anticipate tailor-made assist to scale commercially viable options with deep sectoral insights resulting in excessive progress.

Published – October 10, 2025 05:35 pm IST

Leave a Comment