- Home

- Business

- Economy

RBI initiatives inflation at 2.6% for FY26, decrease than the sooner estimate of three.1%

Updated – October 01, 2025 04:24 pm IST

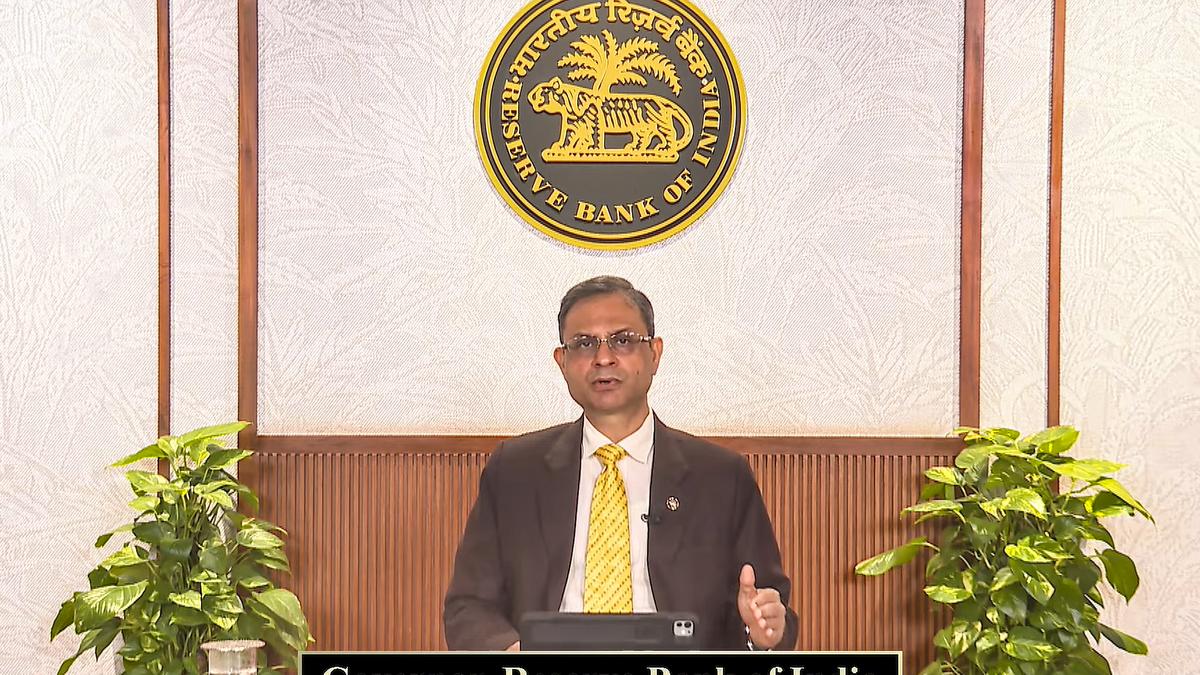

Reserve Bank of India Governor Sanjay Malhotra speaks on Monetary Policy Statement, in New Delhi, on October 1, 2025 | Photo Credit: RBI

The Reserve Bank of India (RBI) on Wednesday (October 1, 2025) saved its coverage rate of interest unchanged at 5.5% for the second consecutive time, citing considerations over tariff uncertainties.

Announcing the fourth bi-monthly financial coverage of the present fiscal, RBI Governor Sanjay Malhotra mentioned the Monetary Policy Committee (MPC) unanimously determined to maintain the short-term lending price or repo price unchanged at 5.5% with a impartial stance.

The October coverage comes inside weeks of a reduce in Goods and Services Tax (GST) and at a time when demand is prone to be created within the home market amid the tariff strain.

The retail inflation is trending under 4% since February this yr. It eased to a six-year low of two.07% in August, aided by an easing of meals costs and a beneficial base impact.

Follow the reside updates right here:

WATCH: RBI Governor Sanjay Malhotra pronounces financial coverage

-

October 01, 2025 15:26

CREDAI, NAREDCO urge RBI to chop repo price in subsequent meet to boost housing demand

Realtors’ physique CREDAI and NAREDCO on Wednesday urged the RBI to scale back the important thing repo price within the subsequent financial coverage to spice up demand for residential properties, particularly of inexpensive properties.They additionally hoped that banks would go on the advantages of earlier price cuts to current and new house mortgage debtors.

Commenting on the RBI coverage, CREDAI National President Shekhar Patel, mentioned, “The RBI’s choice to carry the repo price at 5.5 per cent offers the housing sector the stability it wants amid world uncertainty. Predictable borrowing prices enable consumers to plan long-term and provides builders the readability to progress financing and initiatives.” He famous that the latest GST charges rationalisation has lifted shopper sentiment and elevated demand throughout sectors.

“While markets had anticipated a 25-basis level reduce at present, we stay hopeful the RBI will ship a cumulative 50-basis level easing this fiscal in two tranches, which might additional assist exercise,” Patel mentioned.

It is important that banks go these advantages to each new and current debtors so coverage continuity and tax reform translate into sustained demand via the festive season, the CREDAI President mentioned.

– PTI

-

October 01, 2025 15:19

No proposal to levy fees on UPI transactions: RBI Governor Malhotra

Reserve Bank Governor Sanjay Malhotra on Wednesday (October 1, 2025) mentioned there isn’t a proposal to levy any cost on UPI transactions.The Governor additionally mentioned the central financial institution is analyzing a proposal to permit lenders to remotely lock cellphones purchased on credit score in case of default in EMI funds.

Read extra on this right here..

-

October 01, 2025 14:05

RBI’s choice to carry the repo price at 5.50% displays confidence in India Inc’s progress prospect: Tata Capital

“The RBI’s choice to carry the repo price at 5.50% displays confidence in India Inc’s progress prospects, signalling that the central financial institution views the financial system as structurally resilient and poised for sustainable, broad-based enlargement. With inflation easing and the outlook benign, it has opted for continuity whereas remaining watchful of world and home dangers.For the monetary sector, this stability anchors inflation expectations whereas sustaining credit score momentum throughout retail, SME, and company segments. The latest GST rationalisation is one other constructive improvement, set to raise family buying energy and gasoline consumption demand, appearing as a strong progress catalyst.

Looking forward, whereas world uncertainties—starting from slower progress to tariff actions—pose challenges, India’s financial fundamentals stay resilient. This mixture of coverage stability, bettering consumption, and sustained credit score demand positions the nation properly for broad-based, long-term progress,” mentioned Rajiv Sabharwal, MD and CEO, Tata Capital Ltd

-

October 01, 2025 13:47

Very prudent coverage within the unsure world situation: CSB financial institution

“A really prudent coverage within the unsure world situation. The slew of measures introduced by RBI of giving extra energy to Bank Boards, bringing world greatest practices via ECL and Basel 3 norms, differential premium on deposits, eradicating giant framework restriction in an period of rising corporations and financial system together with acquisition financing, giving extra leg room to exporters and enabling people to leverage their fairness belongings augurs properly for the financial system,” mentioned Pralay Mondal, MD and CEO, CSB Bank

-

October 01, 2025 12:54

RBI pronounces measures to assist exporters

The Reserve Bank on Wednesday introduced a number of measures to assist exporters tide over challenges posed by the imposition of fifty per cent tariffs by the U.S. administration on Indian shipments.The measures embrace decreased paperwork and compliance burden for small exporters and importers.

“The export sector is a crucial a part of India’s financial system,” mentioned RBI Governor Sanjay Malhotra, whereas asserting steps to additional strengthen the sector and improve ease of doing enterprise for merchants.

One of the important thing measures is the extension of the time interval for repatriation from international forex accounts of Indian exporters in IFSC, from one month to a few months.

In January 2025, the RBI had permitted Indian exporters to open international forex accounts with a financial institution outdoors India for the realisation of export proceeds.

Funds in these accounts can be utilized for making import funds or must be repatriated by the top of subsequent month from the date of receipt of the funds.

“It has now been determined to increase the time interval for repatriation, from one month to a few months, in case of such international forex accounts maintained in IFSC in India,” the RBI mentioned, including this can encourage Indian exporters to open accounts with IFSC Banking Units and likewise enhance foreign exchange liquidity in IFSC.

-PTI

-

October 01, 2025 12:23

Stock markets lengthen morning beneficial properties submit RBI coverage; sensex jumps practically 600 factors

Benchmark indices Sensex and Nifty prolonged early beneficial properties and had been buying and selling considerably increased on Wednesday (October 1, 2025), helped by shopping for in financial institution shares, after the Reserve Bank of India (RBI) saved its coverage rate of interest unchanged at 5.5% for the second consecutive time.The rebound within the fairness market got here after an eight day droop.

Read extra right here:

Stock markets lengthen morning beneficial properties submit RBI coverage; sensex jumps practically 600 factors

Sensex and Nifty surge after RBI maintains rate of interest, with financial institution shares main the rally on October 1, 2025.

-

October 01, 2025 12:02

‘RBI is assessing the exterior surroundings earlier than committing to additional motion’: Grant Thornton Bharat

“While the RBI has kept away from asserting a price reduce, the impartial stance is important, adopting a wait-and-watch method. RBI is assessing the exterior surroundings earlier than committing to additional motion,” mentioned Vivek Iyer, Partner and Financial Services Risk Leader, Grant Thornton Bharat.“Meanwhile, the GST reforms are offering fiscal assist to spice up the financial system, giving the RBI extra flexibility, and lowering the necessity to rely solely on financial easing to spice up demand.”

-

October 01, 2025 12:00

‘Stable coverage fosters predictability for patrons’: Indian Bank CEO

“The RBI MPC’s steady coverage fosters predictability for patrons, translating to predictable EMIs and well timed entry to credit score, which aids present consumption plans. This stability, together with reducing the chance weight on MSME and residential actual property, will increase demand on this sector. This helps broader financial aims, together with the continuing efforts to internationalise the Rupee and propel India’s trajectory in direction of developed nation standing,” mentioned Binod Kumar, MD & CEO of Indian Bank.

-

October 01, 2025 11:44

RBI raises FY26 GDP progress projection to six.8%

The Reserve Bank revised upward its progress estimates for the present fiscal yr to six.8 per cent and lowered its inflation projection to 2.6 per cent based mostly on an above-normal monsoon and the rationalisation of GST charges.In August, the Reserve Bank of India (RBI) projected a 6.5 per cent GDP progress price for 2025-26, together with an inflation forecast of three.1 per cent.

RBI Governor Sanjay Malhotra mentioned vital developments on the home entrance, amid a quickly altering world financial panorama, have altered the narrative on growth-inflation dynamics in India.

“Buoyed by good monsoon, the Indian financial system continues to exhibit power by registering the next progress in Q1 2025-26. At the identical time, there was a substantial moderation in headline inflation,” he mentioned.

-PTI

-

October 01, 2025 11:43

Slew of measures to advertise internationalisation of rupee

In a bid to advertise using home forex for cross-border settlements, the Reserve Bank on Wednesday introduced a slew of measures, together with permitting banks to lend in Indian Rupees to non-residents from Bhutan, Nepal and Sri Lanka for bilateral commerce.Observing that India has been making regular progress in using the Indian Rupee for worldwide commerce, RBI Governor Sanjay Malhotra mentioned permission has been granted to Authorised Dealer banks to lend in Indian Rupees to non-residents from Bhutan, Nepal and Sri Lanka for cross-border commerce transactions.

Besides, he proposed to determine clear reference charges for currencies of India’s main buying and selling companions to facilitate INR-based transactions.

RBI has permitted wider use of Special Rupee Vostro Account (SRVA) balances by making them eligible for funding in company bonds and industrial papers.

-PTI

-

October 01, 2025 11:15

‘Access to capital markets might be accelerated’: IndiaBonds cofounder

“Big reform measures for the banking sector, together with a framework for M&A financing and financing towards listed debt securities, might be expanded by home banks. This will speed up entry to capital markets for acquisition financing in addition to funding in mounted revenue and company bonds, with funding framework in place within the close to future,” mentioned Vishal Goenka, cofounder of IndiaBonds.com.

-

October 01, 2025 11:05

FY26 progress projection to six.8%, from earlier estimate of 6.5%

The RBI Governor mentioned that the expansion projection for FY26 was raised to six.8% from the sooner estimate of 6.5%

-

October 01, 2025 10:57

‘Unchanged charges assist maintain purchaser sentiment however doesn’t enhance housing affordability’: ANAROCK Group

“RBI’s choice to maintain the repo price unchanged at 5.5% maintains house mortgage EMIs at present ranges, which helps maintain purchaser sentiment however doesn’t enhance housing affordability. This stability means current house mortgage debtors gained’t see any speedy EMI adjustments, whereas new debtors will discover mortgage rates of interest holding regular,” mentioned Anuj Puri, chairman, ANAROCK Group.“The mixture of steady rates of interest and decrease development prices creates a beneficial surroundings for housing demand, particularly through the ongoing festive season.”

-

October 01, 2025 10:46

Dovish pause, says KMB chief economist

“In line with our expectations, the MPC has delivered a dovish pause throughout charges and stance. The progress dangers from tariff uncertainties have created room for added price cuts if dangers materialise. We see scope for 25-50bp price cuts in remainder of FY26,” mentioned Upasna Bhardwaj, chief economist, Kotak Mahindra Bank.

-

October 01, 2025 10:38

‘Indian financial system continues to exhibit power by registering the next progress in Q1’

Governor Malhotra mentioned that for the reason that August coverage assembly, vital developments on the home entrance, amid a fast-changing world financial surroundings, have altered the expansion and inflation narrative in India.He said, “Since the August coverage assembly, vital developments on the home entrance amidst a fast-changing world financial panorama have altered the narrative on progress inflation dynamics in India. Buoyed by monsoon, the Indian financial system continues to exhibit power by registering the next progress in Q1”.

-

October 01, 2025 10:35

India’s international trade reserves stood at $700.2 billion as of Sept 26

India’s international trade reserves stood at $700.2 billion of September 26, down practically $3 billion week-on-week, Sanjay Malhotra mentioned.The Reserve Bank of India has been often stepping in to assist the rupee over latest weeks because the forex confronts persistent headwinds on account of steep U.S. tariffs and tighter immigration insurance policies.

In the week to which the info pertains, the rupee had declined to an all-time low of 88.7975. The forex was final at 88.7150 per U.S. greenback, up 0.1% on day.

-Reuters

-

October 01, 2025 10:26

‘Tariff and commerce coverage uncertainties will affect exterior demand’

“Ongoing tariff and commerce coverage uncertainties will affect exterior demand, and extended geopolitical rigidity and volatility in worldwide monetary markets attributable to the chance of sentiments of buyers pose draw back dangers to the expansion outlook,” mentioned Governor Malhotra.

-

October 01, 2025 10:15

Real GDP progress for FY26 is now projected at 6.8%

Real GDP progress for FY26 is now projected at 6.8%. This has been revised upwards from earlier projection of 6.5%.

-

October 01, 2025 10:13

Inflation for this yr revised: Governor Malhotra

“The MPC noticed that the general inflation outlook turned much more benign in the previous few months as a result of sharp decline in meals costs and the rationalisation of GST charges. The common headline inflation for this yr has been consequently revised lowered from 3.7% in June to three.1% in August, now 2.6%,” mentioned RBI Governor Sanjay Malhotra.

-

October 01, 2025 10:05

MPC holds repo price at 5.5%

The RBI MPC members unanimously determined to maintain the repo price unchanged at 5.5%The STF price stays at 5.5% whereas the MSF price and financial institution price stay at 5.75%

The MPC additionally determined to proceed with a impartial stance.

-

October 01, 2025 09:54

Stock markets commerce increased forward of RBI’s rate of interest choice

Benchmark indices Sensex and Nifty had been buying and selling within the constructive territory in early commerce on Wednesday, after eight days of decline, on value-buying at decrease ranges forward of the RBI’s rate of interest choice later within the day.The 30-share BSE Sensex climbed 142.63 factors to 80,410.25 in early commerce. The 50-share NSE Nifty went up by 50.75 factors to 24,661.85.

-PTI

-

October 01, 2025 09:49

August assembly recap: MPC retains repo price unchanged at 5.5%

The Monetary Policy Committee (MPC) in August 2025 voted to keep up the coverage repo price at 5.50%.This choice was in consonance with the target of reaching the medium-term goal for shopper worth index (CPI) inflation of 4percentwithin a band of +/- 2%, whereas supporting progress.

Read extra right here:

MPC retains repo price unchanged at 5.5%, GDP progress maintained at 6.5%, inflation forecast at 3.1%

RBI MPC retains repo price unchanged at 5.5% as a result of easing inflation and constructive financial outlook.

-

October 01, 2025 09:44

To be or to not be: With GST tailwind, Monetary Policy Committee prone to maintain charges

The three-day closed-door Monetary Policy Committee (MPC) assembly, which commenced on Monday (September 29, 2025), has raised hopes of a price reduce.The October coverage comes inside weeks of a reduce in Goods and Services Tax (GST) and at a time when demand is prone to be created within the home market amid the tariff strain.

Analysts are divided on whether or not the speed fixing panel would vote for a price reduce or keep established order, contemplating the constructive affect of GST reduce on GDP progress and to additional management inflation.

Read extra right here:

To be or to not be: With GST tailwind, Monetary Policy Committee prone to maintain charges

Analysts divided on repo price reduce or established order submit GST affect; ICRA predicts established order.

Published – October 01, 2025 09:40 am IST

- Access 10 free tales each month

- Save tales to learn later

- Access to touch upon each story

- Sign-up/handle your publication subscriptions with a single click on

- Get notified by e-mail for early entry to reductions & affords on our merchandise

${ ind + 1 } ${ system }Last energetic – ${ la }

Leave a Comment